Banking Circle (UK)

Last Updated January 2024

Banking Circle Overview

Banking Circle is our primary banking provider and provides our most comprehensive range of funding currencies.

IMPORTANT:

During onboarding, you will need to provide us with:

• your business registration country

• the countries from where your business is currently operating from and

• the country where your corporate bank account is located and from where funds will be transferred to your Nium account.Our teams will use this information to guide you on which banking partner to use for an optimal funding experience.

Virtual IBANs

Banking Circle provides a virtual IBAN for each funding account. You can use this virtual IBAN to transfer money to your Nium funding account. Transferring money to a virtual IBAN is the same as sending a bank transfer to a regular account number. Once Banking Circle receives the transfer, it will automatically be applied to your funding account.

The virtual IBAN can be retrieved from the Nium Portal by following the instructions found in the section How do I deposit money to a funding account.

How much does Banking Circle cost?

Nium does not charge a fee for funding with any Bank. Your bank will likely charge for an outbound wire transfer, and some bank charges may be applied by Banking Circle. If you do not select “Charges to be borne by sender” when you send your transfer, your funds will be credited to Nium net of any charges.

Banking Circle transfer types

Three main types of payments are routed via Banking Circle:

- Local payments in GBP

- SEPA transfers in EUR

- Cross-border (SWIFT) payment for all currencies

GBP transfers

Banking Circle can receive Faster Payments, BACS, and CHAPS if you transfer GBP from within the UK.

If you are transferring GBP from outside the UK, it must be sent as a cross-border payment. In this case, transfers reach Banking Circle by routing through a partner bank (NatWest). In addition to the BIC that identifies the destination of the funds (SAPYGB2L), you will also need to include Banking Circle's partner bank's BIC (NWBKGB2L, as shown below). This tells your bank where and how to send the transfer to Banking Circle.

This is the routing information for a Banking Circle GBP transfer:

| Currency | Account name | Account | BIC or sort code | Notes |

|---|---|---|---|---|

| GBP | Ixaris Solutions Ltd | Last 8 digits of IBAN | 608382 | For BACS and Faster Payments |

| GBP | Ixaris Solutions Ltd | Last 8 digits of IBAN | SAPYGB2L | For CHAPS |

| GBP | Ixaris Solutions Ltd | GB******** | SAPYGB2L | Intermediary BIC code for Swift Payments: NWBKGB2LXXX |

UK Bank Address:

Banking Circle S.A

24 King William Street, Floor 9, London, United Kingdom

SEPA Transfers (EUR)

SEPA Credit Transfers

Banking Circle has direct access to the SEPA scheme through their German partner bank (Bundesbank). This IBAN should only be used for SEPA Credit Transfers. Any transfers not sent through SEPA on this virtual IBAN can be declined.

This is the information required for a Banking Circle EUR SEPA Credit transfer:

| Currency | Account name | Account | BIC or sort code |

|---|---|---|---|

| EUR | Ixaris Solutions Ltd | DE******** | SXPYDEHH |

Germany Bank Address:

Banking Circle S.A.

20095 Hamburg,

Germany

SEPA Instant Transfers

Banking Circle is a participant in the SEPA Instant Scheme. This funding option enables clients to fund their EUR funding account in seconds, at any time of the day, including weekends and public holidays. The maximum amount that can be transferred through SEPA Instant is EUR 100,000.

SEPA Instant is only available to clients within the European Economic Area (EEA), providing that the remitting bank also participates in the SEPA Instant Scheme. You may check if your bank participates in the SEPA Instant Scheme by visiting this page or enquiring directly with your bank.

The same virtual IBAN and BIC used for SEPA Credit Transfers are used for SEPA Instant Transfers as per the below example:

| Currency | Account name | Account | BIC or sort code | Notes |

|---|---|---|---|---|

| EUR | Ixaris Solutions Ltd | DE******** | SXPYDEHH | For such payments, please send payment as “SEPA Instant Transfers”. |

Germany Bank Address:

Banking Circle S.A.

20095 Hamburg,

Germany

Cross-border (multi-currency) transfers

Banking Circle's Danish entity supports multi-currency cross-border payments. These payments reach Banking Circle through their UK partner bank (Citibank). In addition to the BIC that identifies the destination of the transfer (SXPYDKKK), you will also need to include Banking Circle's partner bank's BIC (CITIGB2L, as shown below). This tells your bank where and how to send the transfer to Banking Circle.

Please note you can also send EUR payments with these routing details. EUR can be sent as a SEPA Credit Transfer or cross-border SWIFT instruction. However, it is essential to note that for EUR payments to arrive in a timely and efficient way, we suggest using the DE IBAN shown in the SEPA EUR section above if you are processing a SEPA transfer; otherwise, use the DK IBAN shown below if you are processing a cross-border SWIFT transfer.

| Currency | Account name | Account | BIC | Intermediary BIC |

|---|---|---|---|---|

| AED | Ixaris Solutions Ltd | DK******** | SXPYDKKK | CITIGB2L |

| AUD | Ixaris Solutions Ltd | DK******** | SXPYDKKK | CITIGB2L |

| CAD | Ixaris Solutions Ltd | DK******** | SXPYDKKK | CITIGB2L |

| CHF | Ixaris Solutions Ltd | DK******** | SXPYDKKK | CITIGB2L |

| CZK | Ixaris Solutions Ltd | DK******** | SXPYDKKK | CITIGB2L |

| DKK* | Ixaris Solutions Ltd | DK******** | SXPYDKKK | CITIGB2L |

| EUR | Ixaris Solutions Ltd | DK******** | SXPYDKKK | CITIGB2L |

| HKD | Ixaris Solutions Ltd | DK******** | SXPYDKKK | CITIGB2L |

| HUF | Ixaris Solutions Ltd | DK******** | SXPYDKKK | CITIGB2L |

| ILS | Ixaris Solutions Ltd | DK******** | SXPYDKKK | CITIGB2L |

| JPY | Ixaris Solutions Ltd | DK******** | SXPYDKKK | CITIGB2L |

| MXN | Ixaris Solutions Ltd | DK******** | SXPYDKKK | CITIGB2L |

| NOK | Ixaris Solutions Ltd | DK******** | SXPYDKKK | CITIGB2L |

| NZD | Ixaris Solutions Ltd | DK******** | SXPYDKKK | CITIGB2L |

| PLN | Ixaris Solutions Ltd | DK******** | SXPYDKKK | CITIGB2L |

| RON | Ixaris Solutions Ltd | DK******** | SXPYDKKK | CITIGB2L |

| SEK | Ixaris Solutions Ltd | DK******** | SXPYDKKK | CITIGB2L |

| SGD | Ixaris Solutions Ltd | DK******** | SXPYDKKK | CITIGB2L |

| TRY | Ixaris Solutions Ltd | DK******** | BCIRLULL | CITIGB2L |

| USD | Ixaris Solutions Ltd | DK******** | SXPYDKKK | CITIGB2L |

| ZAR | Ixaris Solutions Ltd | DK******** | SXPYDKKK | CITIGB2L |

Denmark Bank Address:

Banking Circle S.A.

Philip Heymans Alle 15

2900 Hellerup

Denmark

Note:

Local DKK transfers are not supported by Banking Circle. Please refer to the Barclays (UK) section.

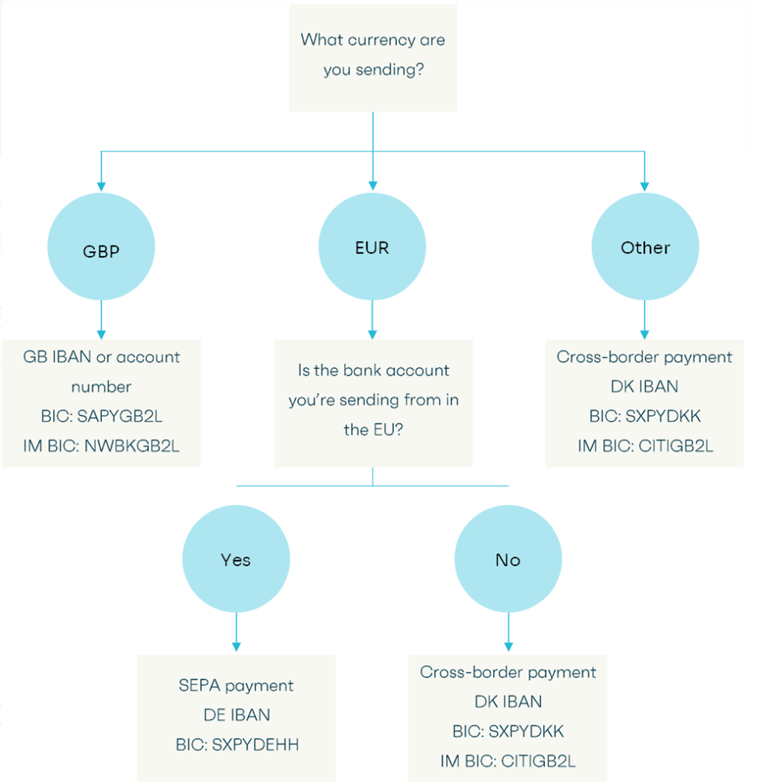

How do I choose where to route Banking Circle Payments?

How long will it take for my transfer to be added to my funding account?

The following are generic timeframes, with "T" being the day of booking and before the processing bank's cut-off time. Your Bank should be able to provide you with their own settlement cycles for each currency, as these may differ according to your bank. Timescales may also be impacted according to your Bank’s cut-off time.

These timeframes are indicative and should only be used as a reference point.

All payments can be subject to screening which, in some instances, may cause a delay to the funds being applied.

| CURRENCY | SETTLEMENT CYCLE | CURRENCY | SETTLEMENT CYCLE |

|---|---|---|---|

| AED | T+2 | JPY | T+1 |

| AUD | T+1 | MXN | T+1 |

| CAD | T | NOK | T+1 |

| CHF | T+1 | NZD | T+1 |

| CZK | T+1 | PLN | T+1 |

| DKK | T+1 | RON | T+2 |

| EUR | T | SEK | T+1 |

| GBP | T | SGD | T+1 |

| HKD | T+1 | TRY | T+2 |

| HUF | T+1 | USD | T |

| ILS | T+1 | ZAR | T+1 |

Banking Circle timeframes

Once Banking Circle receives a transfer, it's instantly credited to your funding account. If a transfer is sent before your bank's cut-off time and is received by Banking Circle (even after working hours), it will be available for you to use - effectively offering a 24/7 credit reflection.

The following days are the only dates when transfers are not processed:

-

1 January

-

Good Friday

-

Easter Monday

-

25 December

-

26 December

Common causes for delays

| The payment was made after your bank’s cut-off times | If your bank’s cut-off time is at 4:00 pm and you request a payment to be sent at 4:15 pm, this payment will not leave your bank until the next processing time, which could also be the next day. Please ask your bank for their cut-off times, as these may affect your outbound payments. |

| Weekends and bank holidays | Payments are not processed on weekends and bank holidays. The processing data will be the next available day (e.g., Monday in case of weekends). |

| Currency holidays | If you send a currency with a country holiday, this may impact your transfer. For example, UK bank holidays will stop GBP from being credited to a GBP account, regardless of where you send your transfer. Transfers can be expected to be deposited on the next working day. The following section lists all currency holidays for 2024. |

Currency holidays for 2024

| JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AED | 1 | - | - | 8, 9, 10, 11, 12 | - | 15, 16, 17, 18 | 7 | - | 15 | - | - | 2, 3 |

| AUD | 4 | - | 29 | 1, 25 | - | 10 | - | 5 | - | 7 | - | 25, 26 |

| CAD | 1 | 19 | 29 | - | 20 | - | 1 | 5 | 2, 30 | 14 | 11 | 25, 26 |

| CHF | 1, 2 | - | 29 | 1 | 1, 9, 20 | - | - | 1 | - | - | - | 25, 26 |

| CZK | 1 | - | 29 | 1 | 1, 8 | - | 5 | - | - | 28 | - | 24, 25, 26 |

| DKK | 1 | - | 28, 29 | 1 | 9, 10, 20 | 5 | - | - | - | - | - | 24, 25, 26, 31 |

| EUR | 1 | - | 29 | 1 | 1 | - | - | - | - | - | - | 25, 26 |

| GBP | 1 | - | 29 | 1 | 6, 27 | - | - | 26 | - | - | - | 25, 26 |

| HKD | 1 | 12, 13 | 29 | 1, 4 | 1, 15 | 10 | 1 | - | 18 | 1, 11 | - | 25, 26 |

| HUF | 1 | - | 15, 29 | 1 | 1, 20 | - | - | 20 | - | 23 | 1 | 24, 25, 26 |

| ILS | 30 | - | 24 | 23, 29 | 14 | 12 | - | 13 | - | 3, 4, 11, 17, 24 | - | - |

| JPY | 1, 2, 3, 8 | 12, 23 | 20 | 29 | 3, 6 | - | 15 | 12 | 16, 23 | 14 | 4 | 31 |

| MXN | 1 | 5 | 18, 28, 29 | - | 1 | - | - | - | 16 | 1 | 18 | 12, 25 |

| NOK | 1 | - | 28, 29 | 1 | 1, 9, 17, 20 | - | - | - | - | - | - | 24, 25, 26 |

| NZD | 1, 2, 22, 29 | 6 | 29 | 1, 25 | - | 3, 28 | - | - | - | 28 | - | 25, 26 |

| PLN | 1 | - | - | 1 | 1, 3, 30 | - | - | 15 | - | - | 1, 11 | 25, 26 |

| RON | 1, 2, 24 | - | - | - | 1, 3, 6 | 24 | - | 15 | - | - | - | 25, 26 |

| SEK | 1 | - | 29 | 1 | 1, 9 | 6, 21 | - | - | - | - | - | 24, 25, 26, 31 |

| SGD | 1 | 12 | 29 | 10 | 1, 12 | 17 | - | 9 | - | 31 | - | 25 |

| TRY | 1 | - | - | 10, 11, 12, 23 | 1 | 17, 18, 19 | 15 | 30 | - | 29 | - | - |

| THB | 1 | 26 | - | 8, 13, 15, 16 | 1, 6, 22 | 3 | 22, 29 | 12 | - | 14, 23 | - | 5, 10, 31 |

| USD | 1, 15 | 19 | - | - | 27 | 19 | 4 | - | 2 | 14 | 11, 28 | 25 |

| ZAR | 1 | - | 21, 29 | 1 | 1 | 17 | - | 9 | 24 | - | - | 16, 25, 26 |

What if a Banking Circle transfer is delayed?

For SEPA credit transfers, please email [email protected] with the date you sent your transfer and your transfer currency and amount. Please also attach your proof of payment for the transfer.

For cross-border transfers, please email [email protected] with the date that you sent the transfer and your transfer currency and amount. Please also attach the MT103 (Swift payment confirmation).

The MT103 is provided by your bank and includes the information below:

| Field | Description |

|---|---|

| 20 | Transaction Reference Number |

| 23B | Bank Operation Code |

| 32A | Value Date / Currency / Interbank Settled |

| 33B | Currency / Original Ordered Amount |

| 50A/ F/ K | Ordering Customer (Payer) |

| 52A /D | Ordering Institution (Payer's Bank) |

| 53A/ B/ D | Sender's Correspondent (Bank) |

| 54A/ B/ D | Receiver's Correspondent (Bank) |

| 56A/ C/ D | Intermediary (Bank) |

| 57A/ B/ C/ D | Account with Institution (Beneficiary's Bank) |

| 59/59A | Beneficiary |

| 70 | Remittance Information (Payment Reference) |

| 71A | Details of Charges (BEN / OUR / SHA)| |

| 72 | Sender to Receiver Information |

| 77B | Regulatory Reporting |

Updated 2 months ago