Chargeback Policy

Product version 3.0

Last edited April 2022

Introduction

This document looks at cardholder disputes, representing most of the chargebacks within Nium's ecosystem. We first outline the general chargeback process and resolution timelines. Then, we cover Nium's chargeback process.

What is a chargeback?

In simple terms, a chargeback is the reversal of a card payment. To obtain such a reversal, a formal dispute process is often required. This is called the chargeback process.

Chargebacks were developed by the card schemes (Visa / Mastercard) to protect consumers against unresolved merchant disputes.

There are four different types of chargebacks

- Authorisation Related Chargebacks. The authorization was declined or not obtained, but the transaction was still processed on your card.

- Fraud Unauthorised or unknown transactions on your card.

- Errors in Processing. The transaction amount differs, or Duplicate Processing or Late processing.

- Cardholder Disputes Goods/services were not provided or not as expected.

Who is involved in a chargeback?

| Cardholder | The person or entity who made the card purchase that is in dispute. |

| Card Company | The organization that oversees the chargeback process on the cardholder’s behalf. — in our case, Ixaris Solutions Ltd. is the Card Company for our UK clients, and Ixaris Financial Services Malta Limited is the Card Company for our EEA clients. |

| Issuer | The bank that the cardholder’s card is connected to and used to purchase the item or service. — in our case, Entropay Ltd. is the issuer for our UK clients and Ixaris Financial Services Malta Limited is the issuer for our EEA client |

| Merchant | The seller of goods or services must defend or accept the chargeback. |

| Acquirer | A financial institution that obtains the rights to the merchant’s account and is tasked with getting payment on the merchant’s behalf. |

| Card Scheme | Visa or Mastercard |

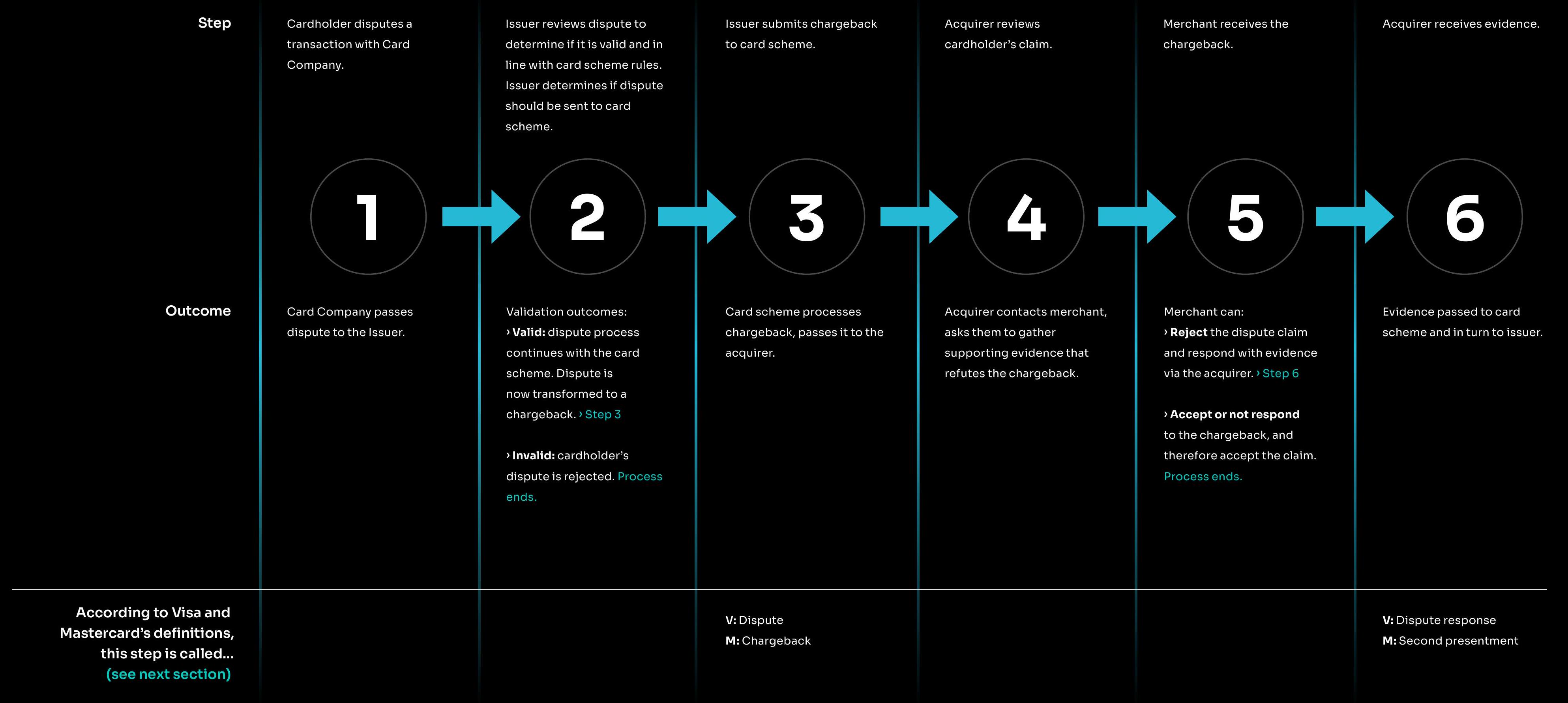

The 12-step chargeback process

Chargeback process timelines

The chargeback process can last from 1 to 6 months.

Resolution time frames defined by Visa

| Stage | Cardholder timeframe | Merchant / Scheme timeframe |

|---|---|---|

| Dispute | Within 120 days from the date you received (or expected to receive) your goods or services, or after you realize the services had ceased. | |

| Dispute response | Within 30 days of the dispute processing date | |

| Pre-arbitration | Within 30 days of the dispute response processing date | |

| Pre-arbitration response | Within 30 days of the pre-arbitration processing date | |

| Arbitration | Within 10 days of the pre-arbitration response processing date | There is no defined the timeframe in which Visa can reply |

Note

Processing date is the date on which the Card Scheme has processed the respective action.

Resolution time frames defined by Mastercard

| Stage | Cardholder timeframe | Merchant / Scheme timeframe |

|---|---|---|

| First chargeback | Within 120 days from the date you received (or expected to receive) your goods or services, or after you realized the services had ceased. | |

| Second presentment | Within 45 days of the processing date. | |

| Second chargeback | Within 45 days of the second presentment processing date, if pre-arbitration filing deadline of 45 days still applies (the acquirer does not respond to pre-arbitration attempt), escalation decision and action must be taken within 75 days from the second presentment. | |

| Arbitration | Within 75 days of the second presentment processing date. | There is no defined timeline in which Mastercard can issue its ruling. |

Note

Processing date is the date on which the Card Scheme has processed the respective action.

Chargeback eligibility criteria

You may be eligible to raise a chargeback in any of these cases:

Cardholder / Consumer Rights Disputes

Services were not provided as expected, or credit was not processed. (See Chargeback Dispute Form)

Errors in Processing

The transaction amount differs from the receipt or checkout form, Duplicate Processing (when a transaction for the same service is processed more than once), or Late processing (when a charge is posted to a credit card account more than 180 days after the transaction date).

Fraud

When the card details are compromised (non-T&E) and an unrecognized transaction is processed by third/external parties (not the cardholder).

For cases where a travel operator or airline has ceased operations, the following criteria must also be met:

According to local law, a bonding authority or similar scheme did not cover the travel service.

OR

A bonding authority or similar scheme covered the travel service according to local law, and the cardholder requested reimbursement from the bonding authority or similar scheme. The cardholder did not receive reimbursement, or the claim was declined.

What is a bonding authority?

A bonding authority is a type of debt security issued by a corporate or government agency. In the case of travel, it can offer a level of consumer protection when travel operators fall into difficulty. An example is the UK's ATOL (Air Travel Organiser's Licence), a financial protection scheme run by the UK Civil Aviation Authority that protects most air package holidays sold by UK-based travel businesses.

For more information, to obtain submission requirements, or for any other type of chargeback not described here, please contact Nium support for assistance.

Dispute submission pre-requisite considerations per reason code

Service provision related to disputed

- Evidenced resolution attempt with the merchant

- An evidenced and detailed description of non-provisioned services

- In cases of merchant inventory insolvency, complete and dated correspondence with the bonding authority proving no resolution reached

- The waiting period for dispute submission is 15 days (Visa) and 30 days (Mastercard) from the expected service provision or bonding authority letter date

Credit not processed

- Evidenced resolution attempt with the merchant

- Voided transaction receipt, credit note, merchant refund acknowledgment (via email or letter), or merchant correspondence requesting collection of refund using chargeback

- Any evidence showing the lack of clear refund I service cancellation policy disclosure from the merchant (not limited to screenshots from the merchant site, merchant checkout form/page, merchant terms and conditions)

Preparing to make a chargeback claim

Before this formal dispute process is started...

- You (the cardholder) must attempt to resolve your dispute with the merchant. Evidence of this will be required if you proceed with the chargeback process. Acceptable proof includes email correspondence, letters, or details logs of phone calls.

- You must also allow the merchant enough time to process any refund before initiating a chargeback claim. At Nium, we recommend waiting at least 30 days after requesting a refund before you initiate a chargeback claim.

- The chargeback process can be very long and costly. All parties should avoid the chargeback process and only raise a chargeback when necessary.

Note:

Before you make a chargeback claim, collect all the relevant information that can help to defend your claim. All supporting documents must be in English or accompanied by an English translation. This includes:

- any merchant communication about the transaction

- proof that your goods / service was not delivered

- proof that you contacted the shop, supplier or seller to resolve the dispute directly (for example an email, letter or fax)

- copy of your invoice or purchase confirmation

- signed terms & conditions, etc.

- copy of your invoice or purchase confirmation, or (for travel related transactions) the PNR log

How to raise a chargeback: General cardholder disputes

STEP 1

You (the cardholder) must fill out the Cardholder dispute: Goods and services not provided > dispute form (Appendix A ) and provide the following:

- Proof that you contacted (or attempted to get with no response) the shop, supplier, or seller (for example, an email, letter, or fax, or in the absence of these, reference to the merchant-supplied telephone number not in use or not responding)

- Copy of your invoice or purchase confirmation or (for travel-related transactions) the PNR log

- Any of the following that applies: Copy of the voided transaction receipt and/or Merchant credit note and/or Merchant site's automatic response on the refund process, complete evidence of refund process activation (such as email confirmation, banner on site, credit case reference number, merchant correspondence confirming refund process active or refund expected date, merchant requesting chargeback or other evidence as agreed with Nium Dispute Management).

STEP 2

We (Nium) will review the provided information and determine if the dispute is eligible for chargeback based on the following criteria:

- In line with the latest card scheme rules

- All supporting document is in English or accompanied by an English translation (however, this does not need to be an official translation)

- A reasonably specific description of the dispute is provided

- A completed and signed dispute form has been provided

- The disputed amount is greater than GBP 15 (or currency equivalent)

- No duplicate chargeback claims

- No refund has already been received for the respective transaction

If the dispute claim is deemed valid, Nium will raise chargeback claims with the Issuer within 15 business days of receiving all required information (and before the chargeback eligibility time frame has closed).

STEP 3

We will inform you of changes to the chargeback state based on the respective card scheme chargeback process (see 12-step chargeback process section).

You will be requested to confirm if you wish to continue disputing a chargeback if the merchant rejects it.

You will also be informed if you need to provide any additional required information (typically, this happens up to 10 calendar days before the closure of the chargeback cycle).

STEP 4

Within 15 business days after the chargeback cycle closes (between 30 and 150 days), we will:

- Provide you with a report showing all fees incurred, and the amount won

- Credit the won amount to your Nium funding account (if applicable)

- Debit any applicable fees from your Nium funding account

Note

If multiple disputes have been raised within the same batch, Nium will wait for all chargebacks within that batch to close.

Important

If a dispute is raised after 90 days from the expected service delivery date or any requested information is not provided within the required timeframe, we cannot guarantee that we will be able to process your dispute

How to raise a chargeback: Failed travel merchant disputes

Nium will, on a best-effort basis, provide you with a list of transactions that may be eligible for dispute based on the transaction information.

You (the cardholder) are responsible for verifying and confirming that all transactions related to a failed travel merchant are included in this report and for adding any missing transactions.

STEP 1

You (the cardholder) must fill out the Cardholder dispute for failed travel merchants dispute form (Appendix B) and provide the following documents:

- The completed excel sheet provided by the Nium support team (see Appendix C: Required fields)

- Proof that a bonding authority or similar scheme does not cover the transaction according to local law OR evidence of the bonding authority or similar scheme's response to the cardholder's reimbursement claim OR proof of bond insufficiency

- A copy of the request for reimbursement if the cardholder (or traveler) requested reimbursement from a bonding authority or similar and did not receive a response

STEP 2

We (Nium) will review this information and determine if the dispute is eligible for chargeback based on the following criteria:

-

In line with the latest card scheme rules

-

All supporting document is in English or accompanied by an English translation (however, this does not need to be an official translation)

-

A reasonably specific description of the dispute is provided

-

A completed and signed dispute form has been provided

-

The disputed amount is greater than GBP 15 (or currency equivalent)

-

No duplicate chargeback claims

-

No refund has already been received for the respective transaction

-

In case of airline failures, the flight was not before the date the airline ceased operations

If the dispute claim is deemed valid, Nium will raise chargeback claims with the Issuer within 15 business days of receiving all required information (and before the chargeback eligibility time frame has closed).

STEP 3

We will inform you of changes to the chargeback state based on the respective card scheme chargeback process (see 12-step chargeback process).

You will be requested to confirm if you wish to continue disputing a chargeback if the merchant rejects it.

You will also be informed if you need to provide any additional required information (typically, this happens up to 10 calendar days before the closure of the chargeback cycle).

STEP 4

Within 15 business days of the chargeback cycle closing (between 30 and 150 days), we will:

-

Provide you with a report showing all fees (see Chargeback fee schedule) incurred and the amount won

-

Credit the won amount to your Nium funding account (if applicable)

-

Debit any applicable fees from your Nium funding account (see Chargeback fee schedule)

Note

If multiple disputes have been raised within the same batch, Nium will wait for all chargebacks within that batch to close.

Important

If a dispute is raised after 90 days from the expected service delivery date or any requested information is not provided within the required timeframe, we cannot guarantee that we will be able to process your dispute.

Chargeback FAQ

Are all disputes processed at the same time?

We endeavor to process all dispute claims within 15 business days. However, in cases where many disputes are received, we will prioritize chargebacks based on the remaining time limit as per card scheme rules.

When will I be reimbursed for the disputed amount?

Within 15 business days of closure of the chargeback cycle (between 30 and 150 days), we will:

- Provide you with a report showing all fees (see Chargeback fee schedule) incurred and the amount won

- Credit the won amount to your Nium funding account (if applicable)

- Debit any applicable fees from your Nium funding account (see Chargeback fee schedule )

Do I need to provide a dispute form for each transaction?

In all cases, a dispute form is required per transaction.

The only exception is in the case of a travel service failure. Since this dispute form will be the same for each transaction, we simply require one signed form.

What are the principles defining dispute resolution?

Once the credit card is captured by the merchant's physical or virtual point of sale (POS) and a transaction is processed (except for Compliance-restricted areas of the event, card acceptor, etc,) the Issuer is obliged to "honor" it, regardless of its origin, legitimacy and irrespective whether a Dispute right exists or not.

Both primary card schemes require the dispute resolution process to be managed in good faith and provide mutual assistance to address the true nature of a dispute permanently. The ultimate goal of dispute resolution is undisrupted acceptance rates and financial impact on cardholders and merchants. Such principles are supported by the accurate presentation of the case particulars, adherence to disputes' timelines, not pushing the opposing member deliberately "over," and last (but not least) true and valid documentation.

What is the "true nature" of a dispute?

The "true nature" of a dispute is usually referenced in the most complex types of disputes that we handle, namely Consumer Rights (cancellations, non-provision or quality of services, credit commitments) and Processing Errors (duplications, excessive and/ or late charges). "True nature" is the essence of the cardholder's complaint, regardless of parallel or similar violations on behalf of the merchant. For example, while misrepresenting a future provision service could be considered "defrauding," it neither constitutes fraud nor an unrecognized charge. It is, therefore, part of the Issuer's duties and responsibilities to challenge documentation and dispute basis to ensure they are addressing the true nature of every dispute.

The benefits of valid, adequately substantiated, and actual disputes include: safeguarding the issuer's and its client's reputation with the card schemes, maintaining high success dispute rates, and managing low dispute operational costs for all involved parties.

Can a dispute's "true nature" be altered during its course?

Typically, no. There is, however, the capability to change the reason code when new information becomes available between representment and (pre) arbitration. For example, a "Service not provided" chargeback can be changed to (partial or total amount) "Credit not processed" when the acquirer provides proof of partial service provision at representment.

What does a good dispute} submission checklist look like?

- Check your timelines, considering that calculations differ based on scheme CPD (central processing date) and system submission requirements - and that even one day counts.

- Ensure you check for previous refunds on your account, especially partial refunds. If, after a partial refund, there is still a disputed basis, please ensure you include the partial (balance remaining) amount.

- Check that your documents are in English, legible, signed where required, and pertain to the true nature of the dispute and the elected dispute reason code.

- Consider that the stronger the case is "built," the better your chances of bearing a favorable resolution without risking arbitration fees.

Why is it important to define my dispute submission as "partial"?

Apart from adhering to the true nature of a dispute, a complete submission on a transaction that was partially refunded removes the only chance to remedy:

- Suppose a merchant represents in full. In such a case, we would have to submit partial pre-arbitration and probably even change the reason code.

- Other lacking transaction cases could have been further addressed at pre-arbitration.

Escalation of a Pre-arbitration to Arbitration: What is the risk of escalating a "weak" case?

You must always attempt to provide all possible and strong evidence with our chargeback submission. When requesting a Pre-Arbitration, elaborate by summarising the case basis with an explanatory note. At Arbitration, we cannot provide more evidence; if we do, the Schemes' Arbitration Ruling committees will not consider it in their decision review. If we escalate a dispute that is not correctly substantiated, this can have a severe financial impact. This is because high filing and ruling fees are imposed on the losing members of a case by Visa and Mastercard. Such fees are standard, cannot be waived, and apply regardless of a case's value. Cost-effective submission is, therefore, a critical factor in our Arbitration escalation decision.

What are a "split ruling" and "violation fees"?

In the sporadic case that the Scheme Arbitration Ruling Committee cannot fully determine liability, they assign equal liability to both opposing parties by dividing the case value by two and settling processing fees accordingly. It is also common for the committee to charge violation fees (even to the winner of an Arbitration ruling) if, for example, the chargeback supporting documentation was incomplete or for other more technical reasons.

What is good evidence to substantiate a "Credit not processed" dispute?

This reason code requires full and transparent disclosure of terms and conditions about cancellations resulting in refunds. Another essential element is the Credit Note or Voided Transaction receipt, which applies to canceled services per the merchant's terms and conditions. A merchant refund acknowledgment using email or mail can also stand.

We do not advise disputing low-value/offer sale or non-flexible, non-refundable tickets that are clearly defined as such on a merchant's site or the checkout page.

Appendix A

Appendix B

Appendix C

Updated about 1 year ago